The 6 Best Apps for Financial Advisors

Many professionals spend a lot of their time on the go – dashing between meetings, moving from office to office, and in the case of finical advisors, putting boots on the ground for client investments. This means that they can spend a considerable amount of their work day out of the office – and if they don’t have a good way to stay connected and productive on the go, they’re missing out on a whole lot of work.

This is especially important for professionals like financial advisors who need to stay connected with clients throughout the day. Of course, it is vital that professionals are able to disconnect and take time off, the key is knowing when to be connected and when to unplug.

It’s generally a good idea not to do work out of your office hours or when you’re on a break. However, if you spend a lot of your work day on the move, it’s important you find a way to stay productive during those hours. But what is the best way to stay productive? We’re going to take you through the best mobile apps for financial advisors that will keep you connected to clients and productive on the move.

6 Essential Apps for Financial Advisors

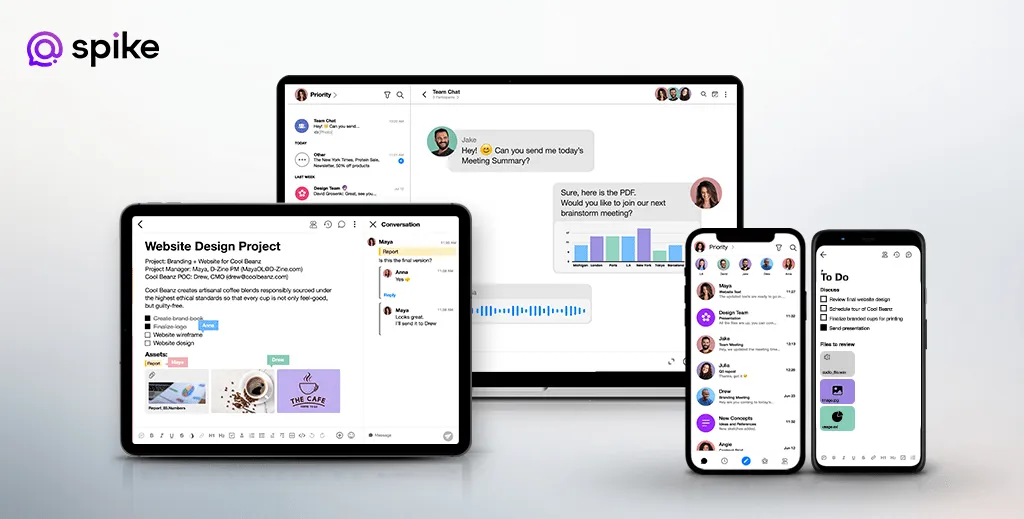

1. Spike (for communication, chat, and email)

The most important mobile app for financial advisors looking to stay connected to their clients on the go is a team communication app, which is what Spike for Team is made for. Spike Teamspace unlocks team chat, external email, and collaboration tool inside a single solution. Here’s what it included:

- Internal Group Chat and Company Wide channels.

- Hosting for your @companyname.com email service

- Customized business email for professional interactions.

- A chat-like experience through the innovative conversational email, which offers up your emails as if they were text messages.

- Video Meetings and Audio Calls for when you need to talk something through with clients on the go.

- Voice Messages for when a text-only memo doesn’t quite get the message across.

Spike Teamspace is much more than a communication service – it’s a complete productivity suite, offering everything you need to collaborate. Spike’s Unified Calendar pulls in appointments from all your connected accounts, while the built-in Tasks and To-Do Lists let you stay on top of your work wherever you are, all without switching apps.

One of the many things that set financial advisors apart from robo-advisors is the human touch, and with Spike’s online notes, you can keep client details updated and to hand, wherever and whenever you need them. Automatically synced across web, desktop, and mobile apps, Online Notes keep you one step ahead of what your clients need.

Pros:

- All-in-one communication, collaboration, and productivity app means no switching between software

- No need to use Google or Microsoft for email hosting

- Simple to use with no complicated learning curve

- Versatile tools perfect for small teams, large companies, and freelancers alike

- Numerous communication channels for flexibility and client choice

Cons:

- Not currently available on Linux

- No live business news stream for financial advisors looking to stay up to date

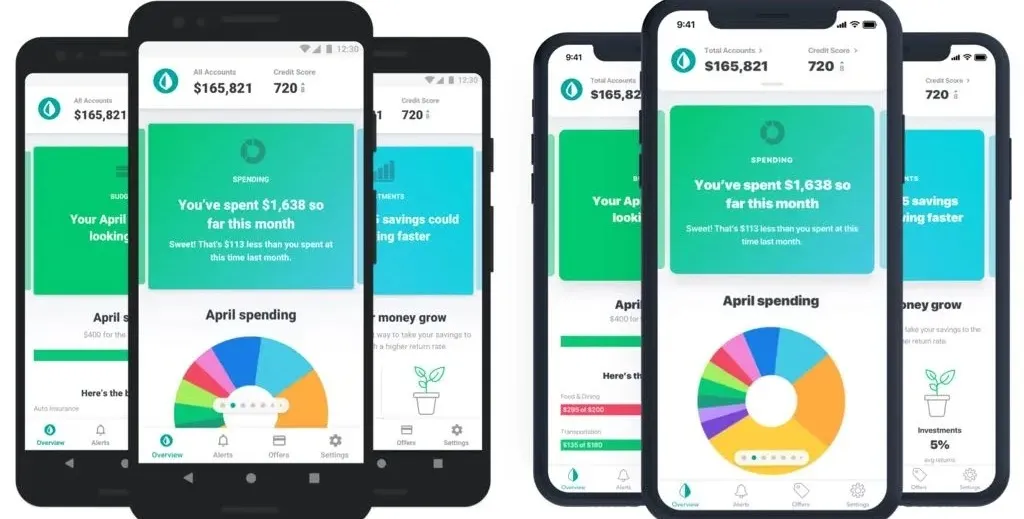

2. Mint (for helping clients with a budget)

Mint, aka Intuit Mint, is a personal finance app that allows users to track their bank accounts, credit cards, loans, transactions, and investments from a single interface. Additionally, it helps users create budgets and set financial goals. As a financial advisor, it may seem counterintuitive to recommend Mint, but it is a useful tool to help clients track the budgets and investments that you have developed with them. What’s more, it’s important to remember that Mint doesn’t offer financial advice, just an aggregated view of financial data.

Having an easy-to-use mobile app to track investments enables clients to stay on top of their assets without having to be in constant contact with you. This is extremely useful if you’re often on the road since taking meetings on the move is particularly tricky.

Pros

- Simple to use for anyone familiar with online banking

- Free to use

- Easy-to-read financial summaries

- Email and text alerts for the client

Cons

- It may not be appropriate for High-Net-Worth clients

- Has ads

- Single-currency only

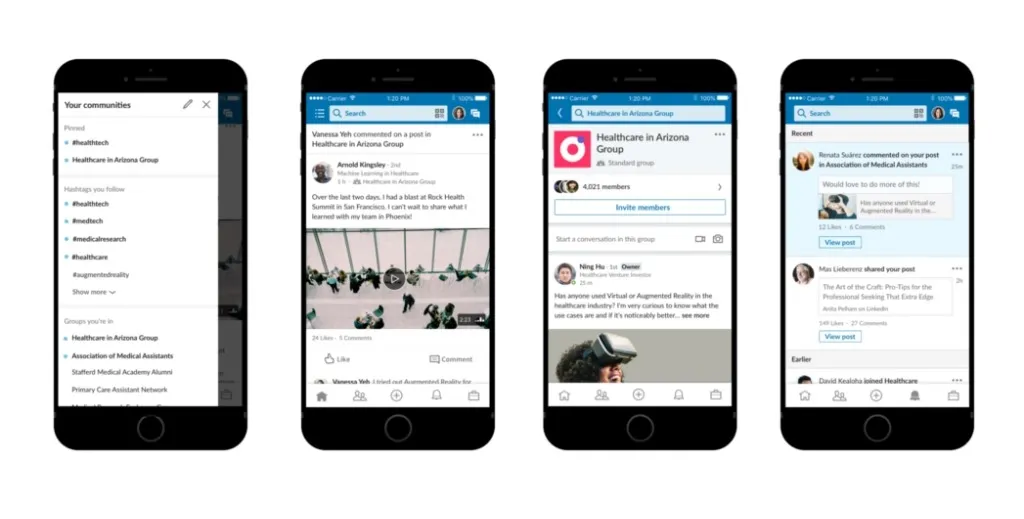

3. LinkedIn (for connecting with clients)

LinkedIn is the online platform for professional networking, with more than 850 million users as of 2021. Available on the web as well as through mobile apps, this is the perfect place to connect with clients on the move.

According to the latest figures from LinkedIn, 60% of the financial advisors who prospected using LinkedIn gained new clients as a result, with almost a third of them reporting that this generated $1 million or more in assets under management. What’s more, more than two-thirds of the financial advisors surveyed said that their target clients were active on LinkedIn. It’s not only about connecting with clients, however, LinkedIn also enables financial advisors to connect with those in their field to form a more robust network.

That said, the research by LinkedIn was conducted some time ago, and with an increasing focus on boosted/paid content rather than organic, as well as more stringent connection requirements, financial advisors may find that they need to pay a premium to reap the rewards of LinkedIn in 2022. Even as a paid service, as far as mobile apps for financial advisors go, LinkedIn is the best option by far for networking with colleagues and clients on the move.

Pros

- It’s a service used by potential clients

- Track record of financial advisors successfully connecting with clients

- Other people in the industry use the network

Cons

- Need the paid features to really get results

- High potential for spam connections

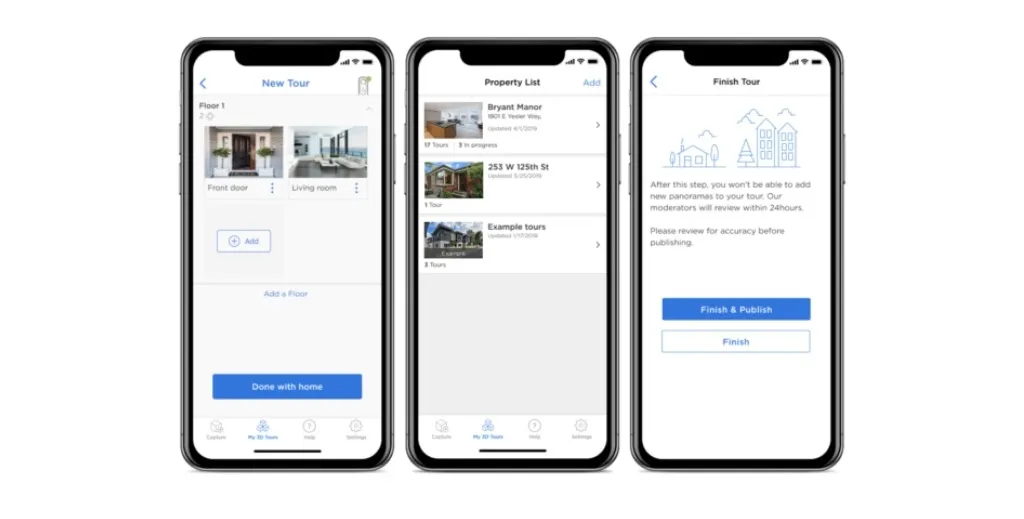

4. Zillow (for tracking investment properties)

Zillow, also called Zillow Group, Inc., is an online real estate platform with a search engine as well as branches in other areas of property rental and purchasing. As far as mobile apps for financial advisors, Zillow offers a way to track investment properties and keep an eye out for any potential new real estate investments.

Zillow has information on more than 110 million homes in the United States, including the important “Zestimate” that estimates the value of a property based on various factors such as historical data and similar properties.

Pros

- Real estate investment is an area of interest to many clients

- A vast, user-friendly database

Cons

- There is some controversy over the accuracy of some Zillow data

- Turbulence in recent years means changing features

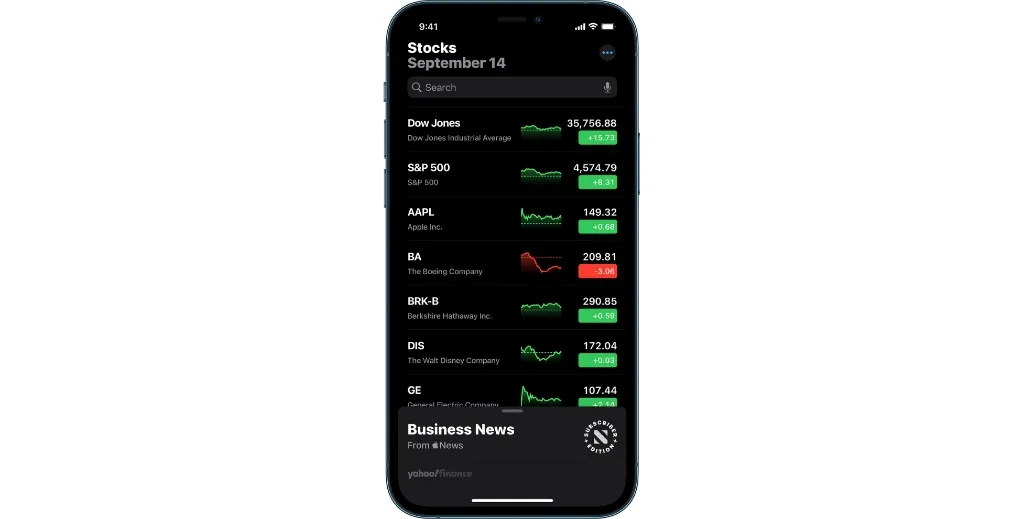

5. Stocks App (for a quick lookup)

The Stocks app comes as standard with iOS devices and gives a very limited, but super quick, look into how listed stocks are doing. In terms of mobile apps for financial advisors, this is one that is good simply by being available. There are alternatives for Android devices, but the Apple Stocks app has come to be relied upon by many for a quick glance at their portfolio.

Along with the customized watchlist and in-depth views, Stocks also offers related business news selected by Apple News editors, making it simple to stay up to date with financial, economic, and small business trends 2022 while on the move.

Pros

- Default app

- Incredibly simple to use

- Offers a customized list

- News offered within the same app

Cons

- Potentially too simple to be of use to some advisors

- Recent updates have caused some problems, especially with the news that is displayed

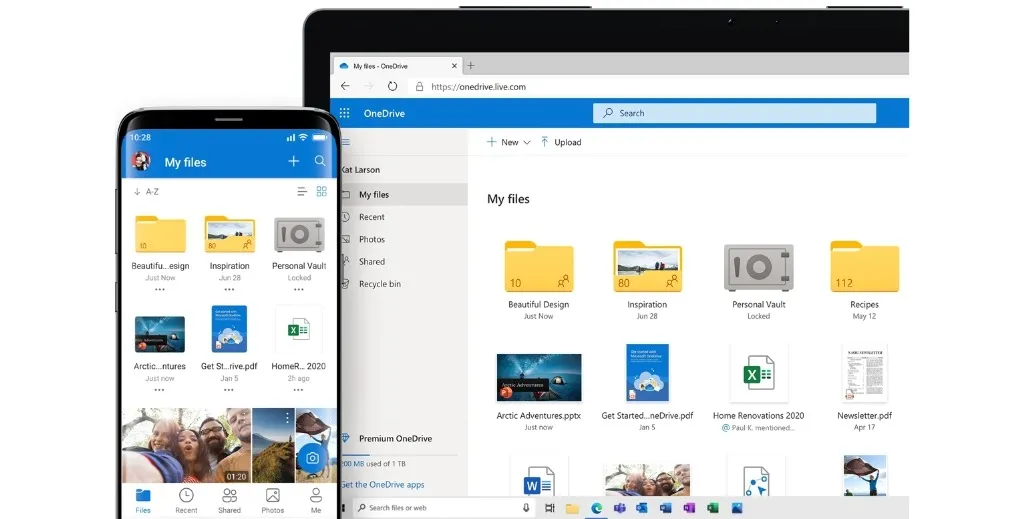

6. OneNote (for client document storage)

Microsoft OneNote is a good mobile app for financial advisors looking for a centralized place to store client notes and documentation. It’s a well-trusted program, having been on the market for almost two decades, and offers a solid array of features including hand drawing and image text-extraction. Importantly for financial advisors, it also has a comprehensive organization system to keep client notes in order.

As with many of Microsoft’s products, it’s a one-trick pony, so think carefully about whether you want a dedicated note-organizing app. You might be better off with an all-in-one productivity app that has online notes built in.

Pros

- Lots of note-input features

- Great organization system

Cons

- The app is only for notes, which means switching between programs

- Can be a little harder to use than other note apps

Wrap Up

Staying connected to clients while on the move is what allows financial advisors to keep the human touch. Always being on the go presents many challenges, but with our list of the best mobile apps for financial advisors, you’ll be able to take some of the work off your shoulders, giving you time to do what you do best.

Whether you’re looking for a tool to keep you communicating, a simple app to watch stocks, or a digital filing system for notes on the move, our list has you covered. Staying productive doesn’t have to mean staying in one place, with the right tools you can provide the best service possible to clients on the go.